Gov. Wolf's tax plan takes center stage as budget hearings begin

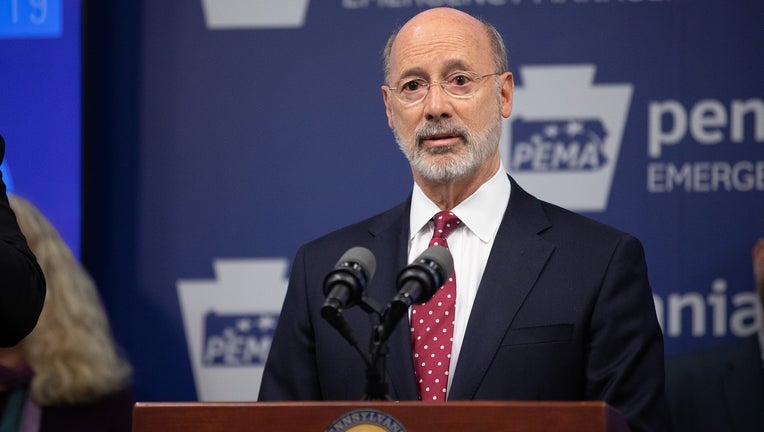

Pennsylvania Gov. Tom Wolf (Office of Gov. Tom Wolf)

HARRISBURG, Pa. - Lawmakers kicked off budget hearings Tuesday as Pennsylvania state government faces a multibillion-dollar revenue gap, a hangover from the ongoing pandemic, and Gov. Tom Wolf's proposal to raise the state income tax, but structure it to shift the new burden to higher earners, is taking center stage.

Republicans, who control the Legislature, questioned whether Wolf's income tax proposal — which is designed to lower taxes on lower-income households and raise them on higher-income households — is constitutional and whether it would work as intended.

Democrats countered that the state cannot wait for federal aid to bail it out of its deficit and that Wolf's proposal would cut taxes for lower-income workers in a state with one of the most regressive tax structures in the nation.

Under the plan for the fiscal year beginning July 1, Wolf, a Democrat, is asking for what his administration calls a $4 billion, full-year income tax increase, or about 25% more.

The money would provide a big boost in aid to public schools and help fill the deficit. Under his plan, the flat rate would rise from 3.07% — one of the nation's lowest — to 4.49%.

The tax-forgiveness exemption for a family of four would rise to $50,000 from $32,000 currently, meaning that households earning under $50,000 would pay not state income tax.

A household of four earning above $50,000, but below $84,000, would see a tax cut, and overall, two-thirds of income-tax payers would pay less or the same, administration officials said.

___

For the latest local news, sports and weather, download the FOX 29 News app.

DOWNLOAD: FOX 29 NEWS APP

Sign up for emails from FOX 29, including our daily Good Day Digest newsletter