IRS admits to erroneously sending $34M in COVID-19 stimulus funds overseas

The IRS has acknowledged that it erroneously sent tens of millions of dollars worth of COVID-19 stimulus checks to people living outside of the United States, according to an audit report conducted by the Treasury Inspector General of Tax Administration (TIGTA) in June.

Back in May, the IRS was busy issuing economic impact payments to millions of Americans as quickly as possible. So much so that a chunk of those $1,200 checks went to ineligible foreign individuals who at one point worked in the U.S., also known as nonresident aliens in tax form terms.

“We conducted our analysis based on reports by news media that individuals who were not U.S. residents were receiving EIPs (economic impact payments),” according to the report.

“Of the 309,601 payments, 27,808 payments totaling $34 million were calculated by the IRS using a tax return with a foreign address,” the report continued.

Only U.S. citizens and U.S. "resident aliens" are eligible for stimulus money — "resident alien" is a federal tax classification, and to qualify, an individual needs a green card or must have been in the U.S. for a certain amount of time, according to the report.

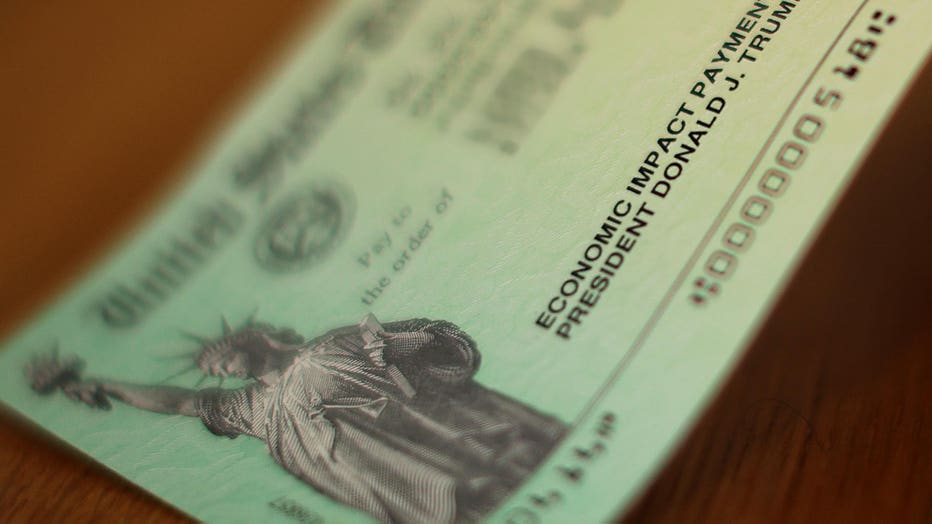

FILE - President Donald Trump's name appears on the coronavirus economic assistance checks that were sent to citizens across the country April 29, 2020 in Washington, D.C. (Chip Somodevilla/Getty Images)

RELATED: Dozens of Austrians reportedly received COVID-19 stimulus checks in mail from US government

The IRS based its economic impact payments on 2018 or 2019 tax returns and assumed resident aliens were still living in the U.S. as of 2020, thus allowing them to mistakenly receive stimulus checks.

“A person who is a qualifying resident alien with a valid Social Security Number is eligible for the Payment only if he or she is a qualifying resident alien in 2020 and could not be claimed as a dependent of another taxpayer for 2020. Aliens who received a payment but are not qualifying resident aliens for 2020 should return the payment to the IRS,” according to the report.

Since the tax agency was operating with limited staff amid coronavirus precautions, there were no employees answering the phone number individuals are supposed to call for mistaken payments. Even taking into account the staffers who have been recently brought back to work, the phone lines are expected to remain unmanned, according to the agency.

“IRS management informed us that, at this time, they are relying on individuals to voluntarily return these payments. We will continue to evaluate the IRS’s issuance of potentially erroneous EIPs and its efforts to recover these payments once identified,” the report stated.

According to the report, the IRS is solely relying on individuals to file their tax forms correctly in the future to ensure a similar mistake would not be made in the event a second round of stimulus checks was issued.

In September, several dozen Austrians received stimulus checks in the mail from the U.S. government.

According to Austrian public broadcaster ORF, two of the recipients, 73-year-old retiree Manfred Barnreiter and his wife, received stimulus checks that were labeled “economic impact payment, President Donald J. Trump.”

Barnreiter took the check to the bank to figure out why he was eligible to be a recipient of the stimulus check but could only point to when he had worked in the U.S. for two years in the 1960s as a waiter.

Additionally, nearly 1.1 million coronavirus relief payments totaling some $1.4 billion went to dead people, a government watchdog reported in June. The Government Accountability Office, Congress’ auditing arm, cited the number of erroneous payments to deceased taxpayers in its report on the government programs.

While the U.S. government asked surviving family members to return the money issued to the deceased, it’s not clear they have to.

The revelation of more than $1 billion in public money erroneously paid out, shines a light on the part of the government’s massive relief program with which most ordinary Americans are most familiar. It follows disclosures that several major restaurant chains and other publicly traded companies had received emergency loans under the $670 billion program for the nation’s struggling small businesses.

Despite some of these glaring errors and the IRS’s dull plan to get those monies returned, Congress is continuing to push forward with another stimulus check.

President-elect Joe Biden and his team announced on Dec. 1 that he would support additional COVID-19 relief beyond any aid package Congress could pass before the end of the year.

RELATED: Biden: Coronavirus relief package during lame-duck period likely 'just a start'

Biden added that his transition team was “already working” on additional relief measures to be proposed in the next session of Congress. The Biden-Harris team established a task force to combat the coronavirus pandemic.

U.S. Treasury officials told NPR that they are "continuing to assess the accuracy of the economic impact payments ... and the recovery efforts for any erroneous payments."

Meanwhile, Congress continues to spar over details concerning a second stimulus check as lockdowns are reinstated and businesses are forced to shut down amid a crippled economy.

Rep. Mitch McConnell said Tuesday he's largely sticking with a partisan, scaled-back COVID-19 relief bill that has already failed twice this fall, even as Democratic leaders and a bipartisan group of moderates offered concessions in hopes of passing pandemic aid before Congress adjourns for the year.

The Kentucky Republican made the announcement after Biden called upon lawmakers to pass a down payment relief bill now with more to come next year. House Speaker Nancy Pelosi resumed talks with Treasury Secretary Steven Mnuchin about a year-end spending package that could include COVID relief provisions. Key Senate moderates rallied behind a scaled-back framework.

McConnell said his bill, which only modestly tweaks an earlier plan blocked by Democrats, would be signed by Trump and that additional legislation could pass next year. But his initiative fell flat with Democrats and a key GOP moderate.

“If it's identical to what (McConnell) brought forth this summer then it's going to be a partisan bill that is not going to become law," said Sen. Susan Collins, R-Maine, who joined moderates in unveiling a $908 billion bipartisan package only hours earlier. “And I want a bill that will become law.”

Democrats declined to release details of their concessions to McConnell.

RELATED: McConnell says 'no reason' coronavirus relief shouldn't pass by year's end

“We don't have time for messaging games. We don't have time for lengthy negotiations," McConnell said. “I would hope that this is something that could be signed into law by the president, be done quickly, deal with the things we can agree on now." He added that there would still be talks about “some additional package of some size.”

McConnell's reworked plan swiftly leaked. A summary ignores key demands of Democrats and moderates such as aid to states and local governments and additional unemployment benefits.

The Associated Press, FOX News and Austin Williams contributed to this report.